By : Dr. Bishwanjit Singh, Loitongbam

Research Scholar

University of International Business and Economics (UIBE), Beijing, China.

Introduction:

The key determinants of a country’s economic development depend on the combination of its factor endowment, technology, institutional structure and policy stance. While not denying the importance of these considerations, the paper tries to examine different view of economic development and underdevelopment, based on the idea that economic activity in North Eastern Region (NER) may agglomerate spatially and international openness causes higher economic growth. One of the reasons of prolonged underdevelopment of NER is the export constraint on the part of NER due to low demand, high trade costs, poor infrastructure and lackadaisical nature of the Government. As a result, the region has benefitted little from India’s trade liberalization. It is said that NER requires more initiatives and investment to develop its own manufacturing base as its manufacturing industry is in infant stage. To find a solution to this problem, it is necessary to examine the trade pattern between India and the rest of the World. On 25th September 2014, PM Narendra Modi launched “Make in India” campaign to make India a manufacturing superpower with 25 thrust sector which includes automobiles, chemicals, IT, pharma, textiles, ports, aviation, leather tourism and hospitality, wellness, railways, etc. The key focus of this campaign are ‘ease of doing business’, focus on Public-Private partnerships, harnessing the potential of Democracy, Demography and Demand. Emphasizing ‘collective responsibility’ for country’s development and focusing on job creation, PM Modi said, “We have to change the economic dynamics; we have to improve manufacturing in a fashion that benefits the poor. This is a cycle, move poor people towards being a part of middle class. Manufacturing boost will create jobs, increasing purchasing power, thereby creating a larger market for manufacturers.” It implies that India needs to develop manufacturing industry to lift poor people out of poverty, as it can provide a large number of employment opportunities for both skilled and unskilled workers. Improving manufacturing sector will create more employment opportunities than that of other sectors. Thus, improving manufacturing helps the country to eradicate poverty by creating more income and employment. In the true spirit of ‘Make in India’ policy, if the NER wants to live on their feet rather than on their knees, it is necessary to change the policies with regional characteristics as well as collective efforts so that the region could become economic powerhouse by converging them into an economic unit. It is suggested that NER should pay attention to improve manufacturing industry by enhancing industrial capabilities as well as by specializing towards its comparative trade advantage commodities. Section II discusses how the regional economic integration and international openness may benefit the development of NER and section III is the conclusion.

2. Regional Economic Agglomeration and Trade Openness:

2.1 Regional Economic Agglomeration:

The spatial agglomeration of industry has been formally analyzed in recent work in economic geography (see Krugman and Venables, 1995) and the goal of the present paper is to find out the implications of this approach for economic development of the region. Why does NER need to pull economic activity into a single location? Some countries trade more because of their proximity to well-populated countries, while some trade less because they are isolated (Frankel & Romer, 1999). This situation is also quite true in the NER of India. The region is trapped in ‘peripheralism’(Barman, 2009) and the population densities of the NER are below the national averages. In most of the NER states, the main towns are small and there only few regional district hubs. For example, hardly any small market towns can provide chain market to commercial farmers for their produce. Besides, the commercial and financial banking activities are very marginal because of small population and areas (Bruner et al., 2010). Why do firms agglomerate in certain places? When trade costs are sufficiently low, firms tend to locate where demand is larger in order to benefit from economies of scale, and demand becomes larger as production of manufactures concentrate. Three main forces shape the process of agglomeration/dispersion of economic activity in space. Firstly, the ‘product market competition’ effect implies that when one worker migrates from Region B to Region A, competition in the latter raises (while it is reduced in the former). Then, firms pay lower wages in Region A relative to Region B as a way to support their competitiveness. This effect clearly constitutes a dispersion force since some workers in Region A will decide to migrate in Region B where the relative wage is higher. Secondly, the ‘home market effect’ implies that, other things being equal, the region with the larger market for a specific product has the higher wage and it is a net exporter of that product (Krugman, 1980): in fact, more workers in Region A entail a larger share of income spent in industrial goods and this allows local firms to pay higher nominal wages, making this location increasingly attractive for more workers (and consequently more firms). As such, Region A becomes an exporter of industrial goods. Thirdly, the ‘price index effect’ implies that a larger share of workers in Region A determines lower prices for industrial products in the local market. In fact, more varieties are produced in Region A and they do not incur in trade costs since most firms produce locally. Thus, prices are lower in Region A relative to Region B. As such, the real wage in Region A as compared to real wage in Region B rises attracting more workers in Region A. The intensity of these three forces as well as the balance between them is determined by the level of trade costs between the two regions.

What factors will determine the economic integration? And why do firms tend to agglomerate? It is due to increasing return to scale, monopolistic competition, transaction costs and the occurrence of external economies and in turn shape firms’ and labors’ location behavior. Increasing returns implies that trade arises to take advantage of scale and variety gains from specialization. Increasing returns encourage manufacturing firms to geographically concentrate their productive activities rather than dispersing them in several locations as a way to benefit from the advantages of scale economies i.e. benefits in terms of production costs deriving from creating larger plants. However, since each firm can increase production while reducing the average cost per unit of product, mere existence of increasing returns does not imply that production is automatically concentrated in a single location. Since firms cannot benefit from increasing returns by concentrating production, they will decide to produce in all locations where consumers are. Thus, it tends to spread economic activity to other parts of the region. Transport costs greatly influence location choices. Firms decide whether it is more convenient to concentrate in just a single location and serve other regions by exports or alternatively incur in additional fixed costs to open up a second plant in a different location. Since each region has the same endowments (i. e. no a priori differences between regions), firms have no incentive to relocate from one region to another since they would face more competition without the possibility to serve the other region’s market by exports due to high trade costs.

Is regional convergence possible in NER? How does clustering of firms in to a single location make possible in NER? There are three main forces that can shape the process of agglomeration/dispersion of economic activity in NER: location of firms to single location, lowering trade costs sufficiently and making NER increasingly attractive for workers and firms. When firms locate to a single location, it creates an incentive for suppliers of intermediates to locate production in the same location, and as production of final goods by clustered firms becomes gradually less expensive due to better access to intermediates, and this effect reinforces industry concentration. In order to illustrate this particular case of high trade costs, consider for example that for an exogenous reason (i.e. historial accident) one worker migrates from region B to region A. Regarding trade costs, higher trade costs lower firms’ profitability, and high trade costs that impede exports as firms in cannot compete in distant markets due to high trade costs. When trade costs are sufficiently low, the dispersion effect is not strong enough to impede concentration. It implies that when trade costs are sufficiently low, the region will be more attractive to workers because of higher wages and more varieties, as well as firms for it will increase their profitability. It will also lower the competition effect so that firms can access to distant markets in addition to the local demand. This lower trade costs and migration of workers will in turn increase demand in NER and firms tend to locate where demand is larger in order to benefit from economies of scale, and demand becomes larger as production of manufactures concentrate. Puga (1996) suggests that agglomeration most likely occurs when the supply of labor is highly elastic. Because it allows firms to draw labor force from the agricultural sector without notable increases in the rural wage rate. In other words, the labor migration from agriculture to manufacturing could only slightly affect the wage differential between rural and industrial activities. Therefore, agglomeration takes place for more rural workers intend to move in industry where wages are relatively higher. However, if the supply of labor is inelastic, then agglomeration does not take place, because the labor migration from agriculture to industry heavily affects the wage ratio between sectors. In case, the agglomeration in NER is more likely to take place as the labor supply is highly elastic.

The classic example of a success story of economic benefit of regional convergence is the early years following German re-unification in 1990. Prior to the fall of the Berlin Wall, East Germany has been well integrated into foreign trade and its exports over GDP (40%) were higher than in West Germany (29%). After the initial re-unification in the early 1990s, the convergence of per capita incomes between East and West Germany has slowed down. During the mid-1990s, growth rates of East Germany exceed than that of West Germany and, since then, growth rates in East and West Germany have levelled off and differences in factor endowments were even more pronounced, resulting cross-border movements of capital, labor, and goods. Unemployment has been persistently above the West German level. East Germany States trade less with the rest of the world than their West Germany counterparts, accounting for 10-13% trade share for East Germany with compared to 24% for West Germany. The share of inward FDI and presence of parents of multinational firms located in East Germany are comparatively low (Buch & Toubal, 2009). Levchenko and Zhang (2012) examine the welfare gain from the trade integration of Eastern Europe after the fall of the Iron Curtain and the role of comparative advantage in the gains from trade. The paper found that Western Europe countries gain mainly expansion of markets, while Eastern European countries mostly benefit from technological transfer from Western to Eastern Europe. Eastern Europe countries are expected to experience large distributional effects due to trade opening.

How does agglomeration benefit NER? According to Alfred Marshall, externalities have three effects: labor market pooling, availability of specialized intermediates and technological spillover effects. First, firms that cluster in a single location take advantage of the availability of pooled labor force and reduce the risk of unemployment as compared to an economy where firms are dispersed. It implies that there is an increase in efficiency emerging from an agglomerating industry connected with a local pooled labor market. Second, when firms concentrate production into a single location they also take advantage of the presence of specialized suppliers of intermediate goods and inputs through the creation of backward and forward linkages between producers of final goods and their suppliers of intermediates (Krugman and Venables, 1995). Third, clustered firms are supposed to benefit from technological spillovers consisting in unintentional flows of knowledge arising from proximity to one another and benefitting the industry as a whole. As a result, firms are encouraged to localize in a single place to benefit from external knowledge arising from other firms’ activities (i.e. R&D).

2.2 Trade Liberalization:

Historically, rapid expansion of international trade renders to high growth in the world. Thus, openness for trade, capital flows, and migration can have an impact on economic growth. Buch & Toubal (2009) examined whether international openness causes higher domestic growth in the context of the fall of the Berlin Wall in 1989. They found that geographical variables play a very significant role in regional openness and higher trade openness increases regional per capita income. What will be the impact of trade liberalization on the geographical distribution of industries of NER? According to traditional trade theory, international trade between countries, both of them benefit of the gains of comparative advantages. The rationale behind trade liberalization suggests that greater competition would induce the production units to improve productivity, which is crucial for accelerating the overall economic growth. Since firms respond to the world market signals, the commodity structure of the country’s trade would undergo changes in accordance with the changing patterns of specialization. According to the Heckscher-Ohlin-Samuelson (H-O-S) model, trade liberalization would induce reallocation of productive resources from the import competing industries to those industries where the country has comparative advantages.

As far as NER’s comparative advantage is concerned, it is believed that it has comparatively trade advantage in producing labor-intensive, semi-skilled-intensive and unskilled-intensive products. Table 1 illustrates the SITC (Standard International Trade Classification) Revision 3 two-digit products that accounted for less than 2 percent of total exports during 1990-2013. India’s export of labor-intensive products and semi-skilled intensive products is either relatively small or more or less constant, and some products are even declining: footwear, tea, inorganic chemicals, spices, tobacco, beverages, etc. From looking at India’s pattern of trade, how can the NER find out its opportunity to participate in India’s trade exports? The answer lies in improving the industrial capabilities and strength of the NER and its major industries i.e. its comparative trade advantage. Industries in the NER are engaged mostly in manufacturing food products, and wood and wood-based products, as well as dealing in some metallic industries, tea, oil, gas and mining sectors (Bruner et al., 2010). Some other potential sectors of this region are agriculture, horticulture, fish farming, handloom and handicrafts and tourism (Goswami et. at., 2012). It is also in line with the ASI survey report 2011-12. According to the report, the outputs of the 13 major industries include tea, food products, beverage, other non-metallic mineral products, etc. Most of them are labor-intensive, unskilled-intensive and semi-unskilled products: an opportunity for the NER to pursue the specialization and production of these products. Table 2 shows the shares of seven major industries in terms of the output within each state of the NER during 2011-12. Comparing Table 1 and 2, shows that the major industries of the NER have a comparative advantage in producing a majority of the products listed in Table 2, which are mostly labor-intensive, semi-skilled-intensive and unskilled-intensive. The NER should focus on specialization on these industries and try to increase firms’ productivities in producing these products.

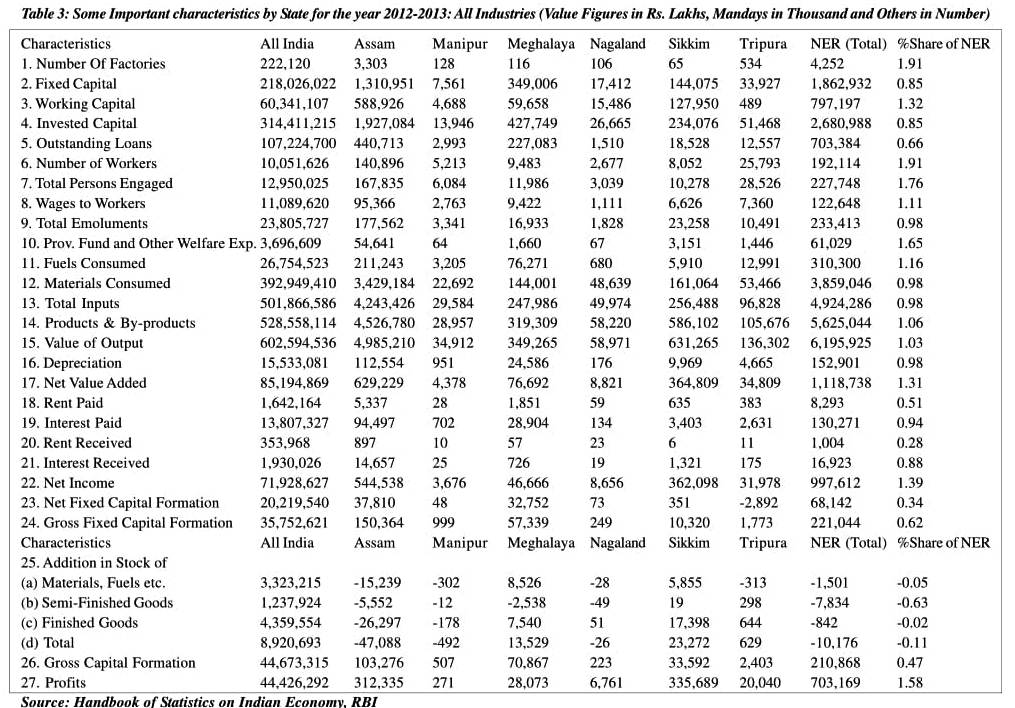

Table 3 gives the information for large industrial firms for all-India and six states of the NER. The NER has only 2% of the factories of Indian total indicating how far the NER lags behind the rest of India in industrialization. Understandably, 78% of the NER’s factories are located at Assam followed by Tripura (13%) and Manipur (0.03%). The total manufacturing output is also low, accounting for a mere 1% of the Indian total. Again, Assam contributes more than 80% of the total manufacturing output of the NER, followed by Sikkim (10.2%). The region’s share of value added accounts for 1.3% of the Indian total, implying inefficiency in input use. The share of profit is also very low: only 2% of the Indian total.

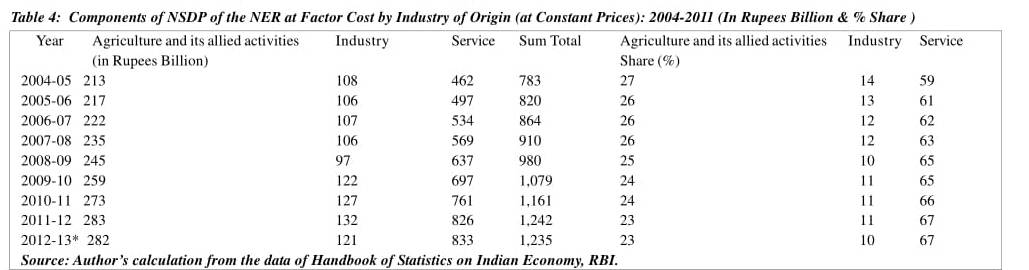

Table 4 presents the sector compositions of the NER at factor cost from 2004 to 2011. The share of agriculture and allied activities exceeds that of the industry sector during the whole sample period. The share of agriculture and its allied activities has increased from 20% in 2004 to 23% in 2011 while that of the industry sector marginally increased from 8% in 2004 to 10.63% in 2011. However, compared with other sectors, the service sector has significantly improved and has contributed a major share to the economic growth of this region (De U.K., 2011), mainly due to a rise in state-sponsored public administration expenditure (Srivastav, 2010). Even though the service sector of the region is growing significantly, it doesn’t create additional employment and income-generating opportunities and its basic structure has not been altered (Srivastav, 2010). The share of the service sector largely increased from 40% in 2004 to 67% in 2011.

* 2012-13 has excluded for Sikkim due to non-availability of data.

From Table 3 and 4, it is shown that industrialization is still underdeveloped and the share of manufacturing activities is below national norms in the region. Only Assam contributes majority of manufacturing output of the region. Thus, the NE states should develop value chains link between their economic activities so that there is a win-win condition prevails among the States. Since Guwahati is the major business hub of the NER, it should act like the New York of the region. Given the infrastructure and economic opportunities, it is prudent to set up most of the business based on Guwahati. It will save time and increase efficiencies and productivities. For example, when most of the companies establish in Guwahati, it will generate and raise income and employment to the local people. Larger the economic activities, higher are the need of resources.

Other parts of the region can supply these resources which in turn will enhance efficient use of ‘once’ underutilized (both natural and human) resources of the region. Moreh of Manipur can act as gateway to the ASEAN economies and eventually to the World. To make these happen, the transportation plays a very crucial role. In addition to improve present road connectivity, it is necessary to think of waterways in every possible ways. The Bharmaputra River has been underutilized so far or at least not up to the extent that it should have. As far as operational of waterways in NER is concerned, it heavily depends on the relationship between India and Bangladesh. Since the route of the NER’s waterways is via Bangladesh, a tacit understanding and mutual cooperation between the two countries is very vital. Otherwise, it will be very difficult to make these waterways fully operational. Both the Centre and the concerned state government should work hand-in-hand in order to use waterways effectively and efficiently in the region. In short, once the regional economic integration takes place, there will be positive spillovers effect to other parts of the region. It also leads to increase economic activities that will, in turn, raise the demand and supply of the region economy.

It is also time to make the local companies to shine as MNCs. How do the presence of foreign MNCs benefit local companies and manufacturing in NER? If the agglomeration with business friendly environment once prevails in NER, there is no way to go backward. Many MNCs will come to NER (for example Guwahati) for doing business due to cost advantage. These MNCs will bring FDI and technology and eventually helping us enhancing productivity of the region through knowledge spillovers. These will accelerate the economic growth of the region. Foreign investors will also come to NER to exploit the opportunities of labor intensive manufacturing exports. Because productivity differences create large variation in incomes across countries, and technology plays a key role in determining productivity. As an example, the introduction of one product might speed up the invention of a competing product, because the second inventor can learn from the first by carefully studying the product or its product design (the “blueprint”). Some of the possible way of technology transfer is through international trade in intermediate goods, export (learning by exporting) and international R&D spillovers. First, the pattern of intermediate goods trade i.e. international economic activities such as trade, FDI, etc. lead to additional contacts with foreign persons who may possess advanced technological knowledge, like exporter, importer, engineers, researchers, this may stimulate the diffusion of foreign technology. Second, through exporting experience companies will benefit from interacting with foreign customer, for example because the latter impose higher product quality standards than domestic customer, while at the same time providing information on how to meet the higher standards. International R&D spillovers are comparatively tricky. Most of the tacit knowledge can be acquired through “by example from master to apprentice” or through person-to-person demonstrations and instructions. Thus, the presence of foreign MNCs will help local entrepreneur and companies in improving their capabilities through FDI and technology spillovers (as stated by Alfred Marshall above).

3. Conclusion:

In what ways NER should look forward to achieve faster economic growth? The paper proposes two suggestions. First, for NER to keep making progress and to transform into a new economic powerhouse, it needs to improve utilization of scarce resources, improvements in technologies, and the exploitation of scale economies. A finer production fragmentation will make it possible to better explore the comparative advantage within the diverse NER. The government should try to lower the cost of cross border merchandise movement and on the other hand, should increase the number of trade items to almost free trade. It will represent deepening of economic and social integration between NER and neighboring countries. Trade liberalization and production fragmentation has the potential to eradicate poverty. For example, the development of China’s processing trade regime has helped lifting thousands of rural poor out of poverty, by creating labor intensive manufacturing jobs for unskilled workers. Development of horticulture, poultry, dairy, and animal husbandry sectors will raise farmers’ income and will help in poverty reduction. Horticulture exports should be promoted according to the principle of comparative advantage. Though horticultural exports would create more rural employment opportunities, it requires labor input and capital input. The latter is very important to ensure the quality of the horticulture products to meet the sanitary and phyto-sanitary (SPS) requirements and to export to both domestic and regulated markets. However, given the sheer size of grain sector and little financially viable options, it is hardly believed that farmers could prosper through growing land-intensive grain. Thus, without a dramatic transformation of NER agricultural trade policy, labor-intensive horticultural exports would not have a chance to grow. Besides horticulture is cash crops and its price is very volatile and hence risky business. Second, one of the major problems of the underdevelopment of NER is that it fails to develop a value chain link among the States. It renders to lower market and inability to develop its manufacturing base. The paper suggests that regional economic integration will provide a better solution for these problems. Regional agglomeration will help NER in achieving faster economic growth through increasing returns, monopolistic competition, transaction costs and the occurrence of external economies and in turn shape firms’ and labors’ location behavior. Besides, the government should promote export sectors, intensively employing unskilled labor, which will create more job opportunities in the cities for rural surplus labors.

All these requires improving physical infrastructure, such as ports, roads, power, telecommunications, etc., an accountable and corrupt-free governance, and mutual cooperation with one another. Besides, a good relationship with Myanmar is very vital for the economic development of NER and Manipur in particular. A good relationship with Indo-Myanmar depends on Indo-China Relation. Myanmar’s polity heavily depends on China and its economy as well. FDI in Myanmar will have a positive spillover towards NER. It also requires people to people contact with NER and China. If we have people to people contact along with cultural bonding, China could help the economic development of NER as China is now a game changer in the world order. The Centre should give local governments additional concessions or preferential policies to FDI, particularly the exporting foreign funded enterprises, through cheap loans, free land use, subsidized energy supply and lax enforcement of environmental law, etc. Transforming NER into a new economic powerhouse will help India becoming an economic superpower sooner than expected.

Finally, we highly recommend whether differences in institutions, regulations, and cultural factors are an issue for keeping the region as a closed economy

(Concluded).